Frequently Asked Questions

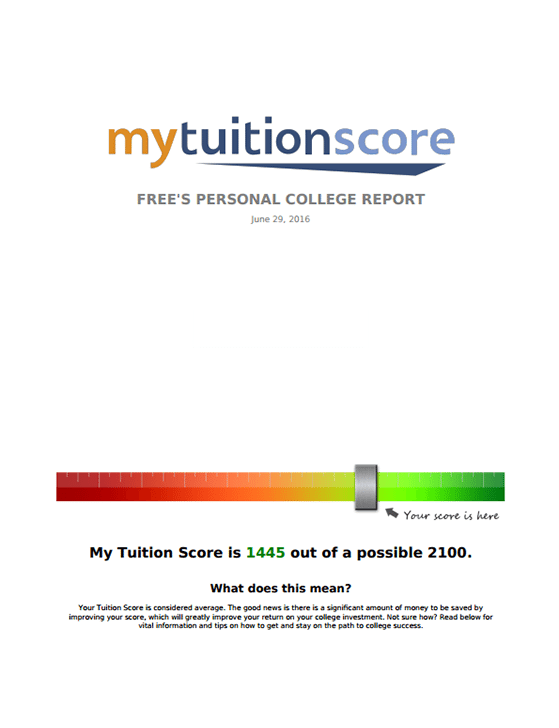

A Tuition Score represents knowledge, preparedness, and financial health relative to the college investment.

Your family’s Tuition Score will be a number ranging between 1 and 2100. The higher the number, the higher the

likelihood of a positive return on investment when spending on college.

With so many families thinking about college and the expense of it, mytuitionscore brings clarity and peace of mind to all of them. It is a convenient way for families to access the information they so desperately need to minimize the cost of college, and to navigate the process without mistakes.

Your counselors are wearing enough hats day to day. The college process is certainly one of them. The financial piece to the college process is one that is overwhelming and begs for many questions to arise. Let mytuitionscore serve as the resource to answer these questions and prepare families without adding one more thing to counselors’ plates. Also, it will allow guidance counselors to have more pointed conversations with students regarding what Colleges are good prospects – both academically and financially.

Mytuitionscore features personalized reports for families. While allowing families to create specific scenarios using their information, it not only shows achievable net costs based on need, but also makes school suggestions, offers a plethora of tips and definitions, features manuals and guides on important topics like loans and scholarships, provides an in depth video on the financial aid process, and so much more.

No! We do not share, sell, or third party any of your info. We are very sensitive to your privacy and security – our only interest is helping you navigate the financial aid landscape.

No problem! You can answer questions with general information rather than family specific, and still receive a report. The more info that you provide - the more accurate your report will be!

As many as you need!

Most college planning sites are focused on only the student. Our focus is to help prepare the entire family. Not only do we take into account a family’s current financial situation, we combine that info with specific colleges’ generosity. (Generosity is how much financial aid a family can expect to receive and how much of it will be ‘free money’ vs. how much will be in the form of a loan.)

For one thing-Wouldn’t you like to know the true cost of a college? You are going to invest hundreds, if not thousands of dollars, on campus visits. Your child may fall in love with a college that is not within reach. By knowing BEFORE you travel to explore a campus, we want to arm you with the info you need and let you know what you can expect to pay.

Several ways! First, your report will provide you with other college options, that you may not have considered. Often Universities with a higher sticker price can end up costing significantly less because of their level of generosity. We’ll provide you with schools that are close geographically to your first choice, schools that are highly ranked in regards to your child’s major, and give you a list of the top 250 most generous schools.

We’re not finished helping! We’ll provide you with a checklist of things you need to do, reminders of important dates regarding submitting your financial aid forms, money saving tips to use when filling out your forms, a financial aid webinar, comprehensive loan and scholarship manuals, videos, and a roadmap. We also give your student access to a myriad of assessments, matching tools, and test prep. Most importantly, tips on raising your tuition score. This higher your score, the lower the cost of college!